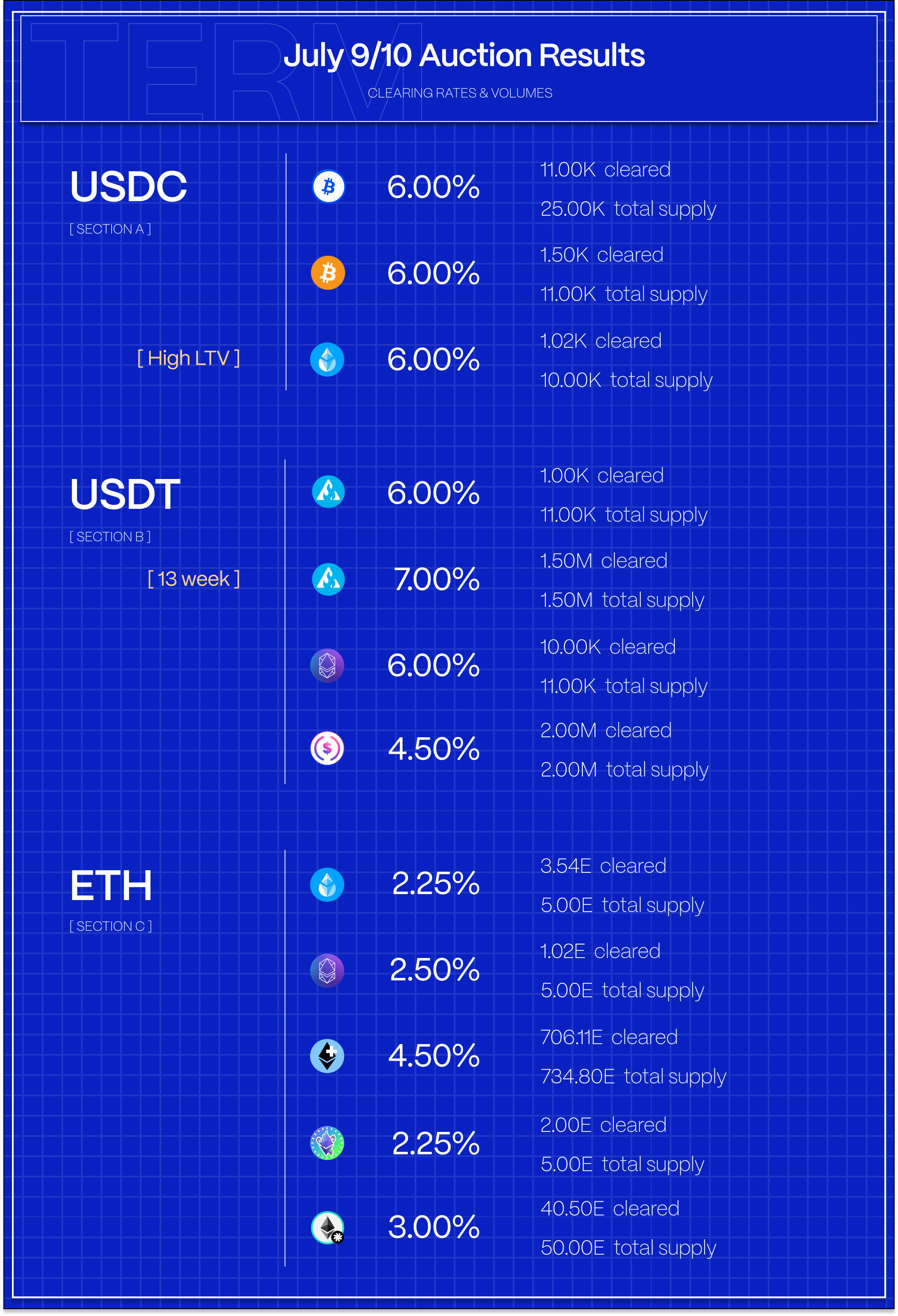

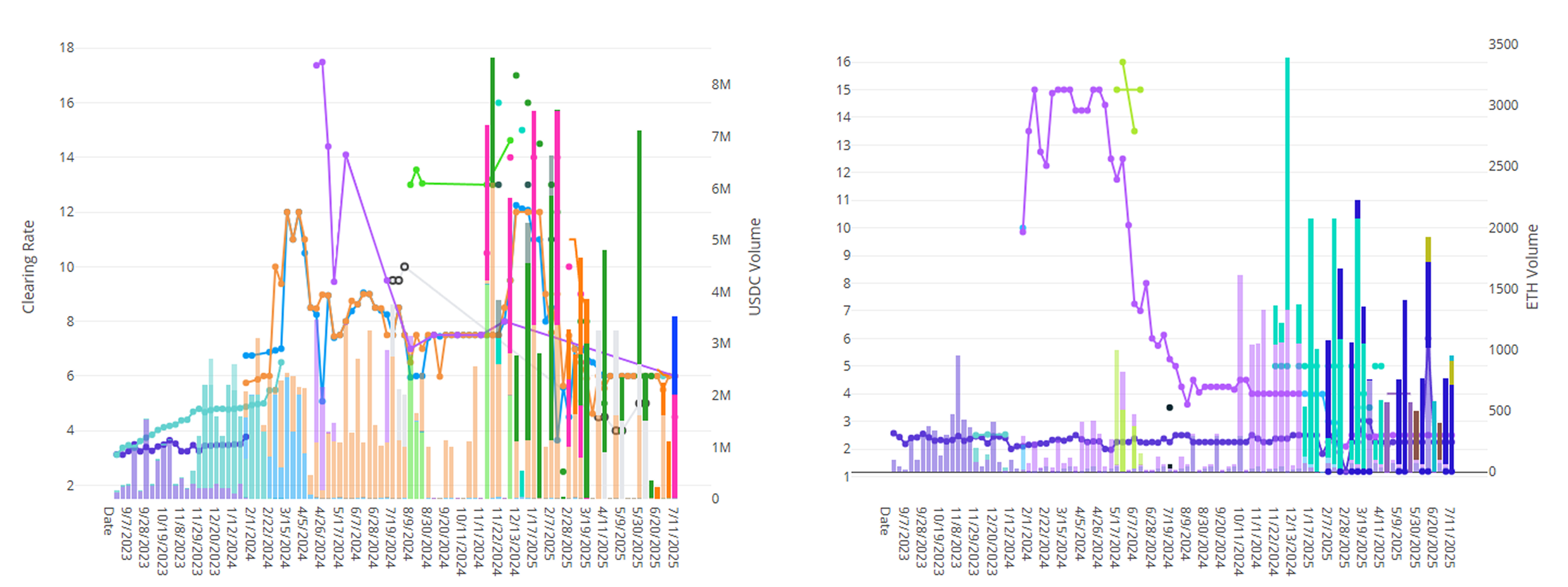

USDT volumes on Avalanche picked up this week with 3.5M cleared across sdeUSD and sAVAX collateral, with sAVAX clearing at a healthy 7% borrow rate. In ETH markets, demand remains robust against ETH+ well north of 4%.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

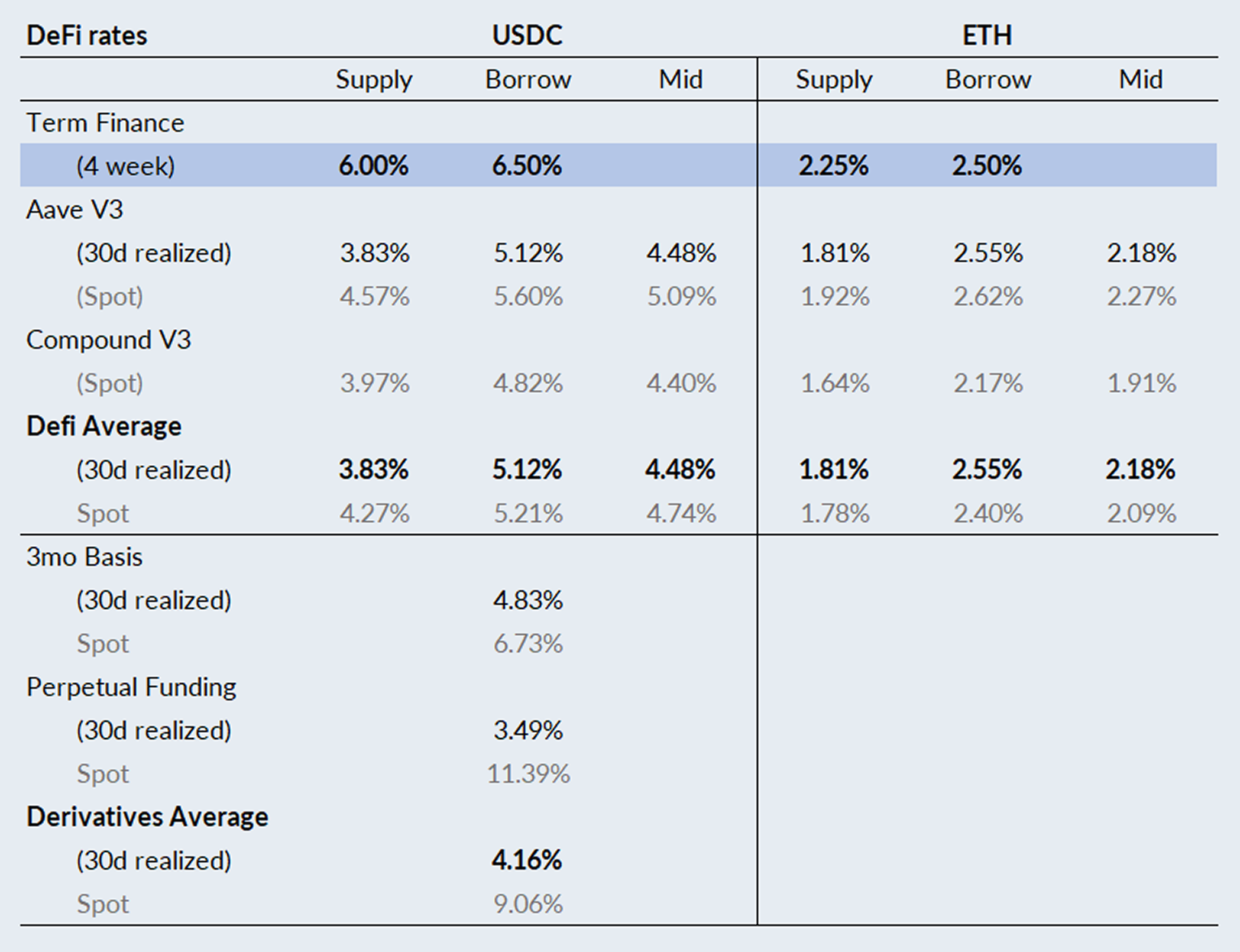

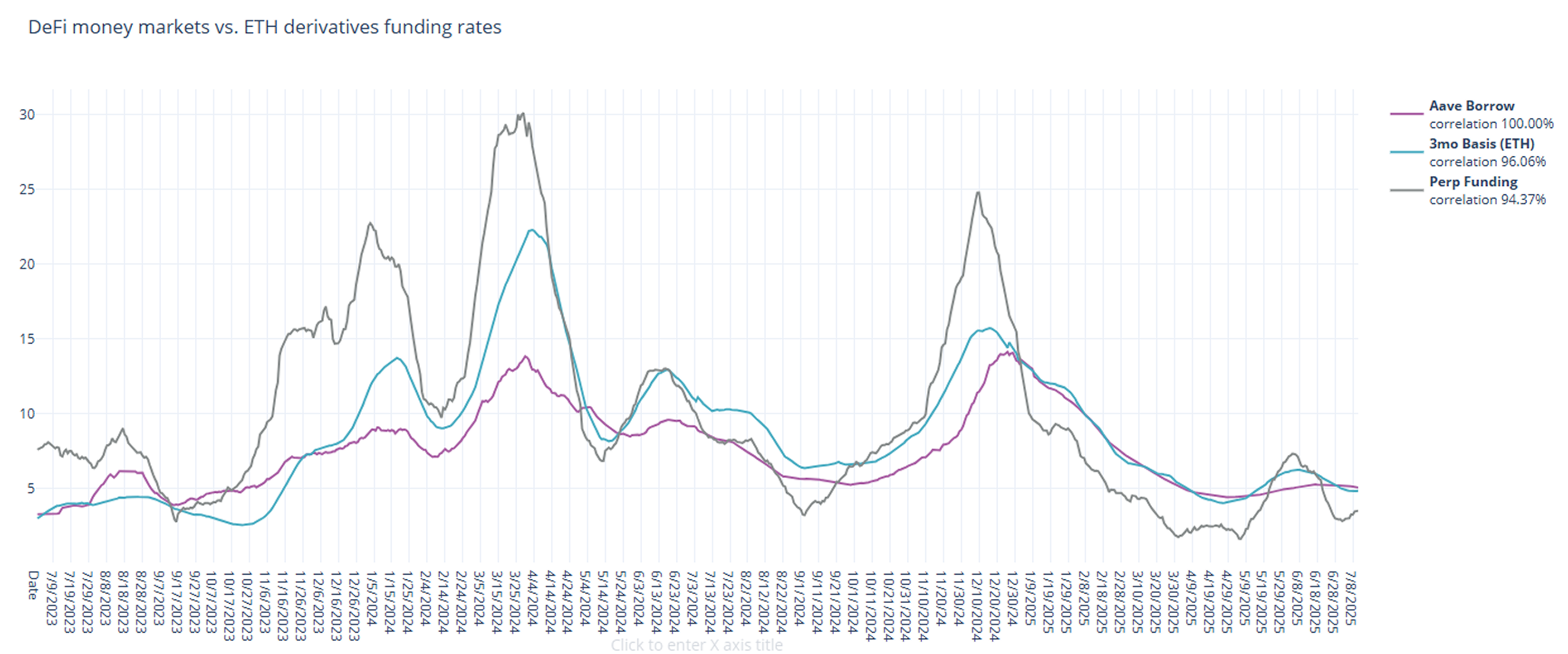

In derivatives markets, funding rates picked up sharply on the back of new highs in BTC. On a 30-day trailing basis, 3-month basis held steady at 4.83% and perpetual funding rates rose by a whopping +53bps, to close the week at 3.49%.

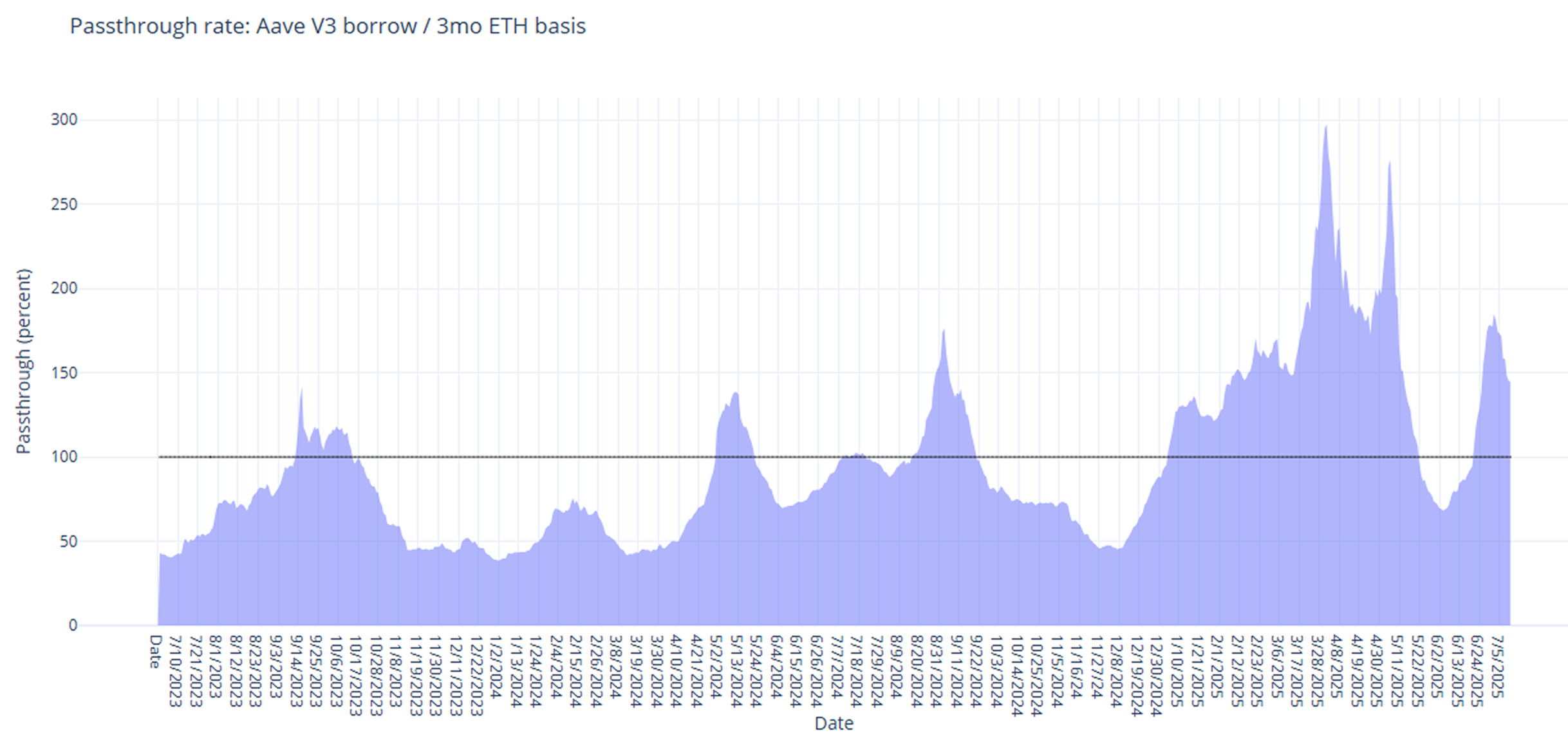

DeFi rates, on the other hand, have been relatively stable, causing the spread between DeFi and derivatives to narrow back toward historical averages.

With BTC breaking through and holding above previous all time highs, risk appetite for leverage is back on the rise. Expect derivatives funding rates to remain elevated in the near term.

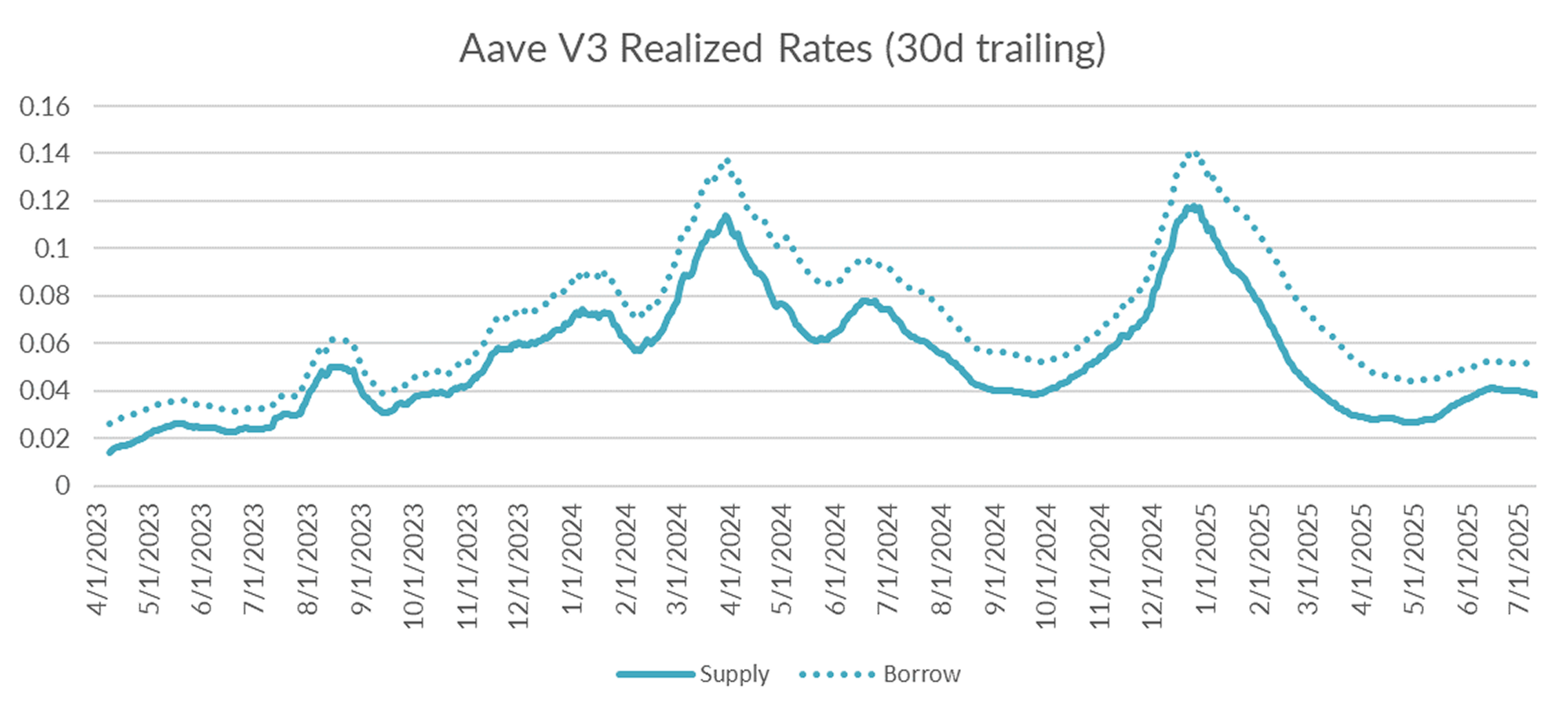

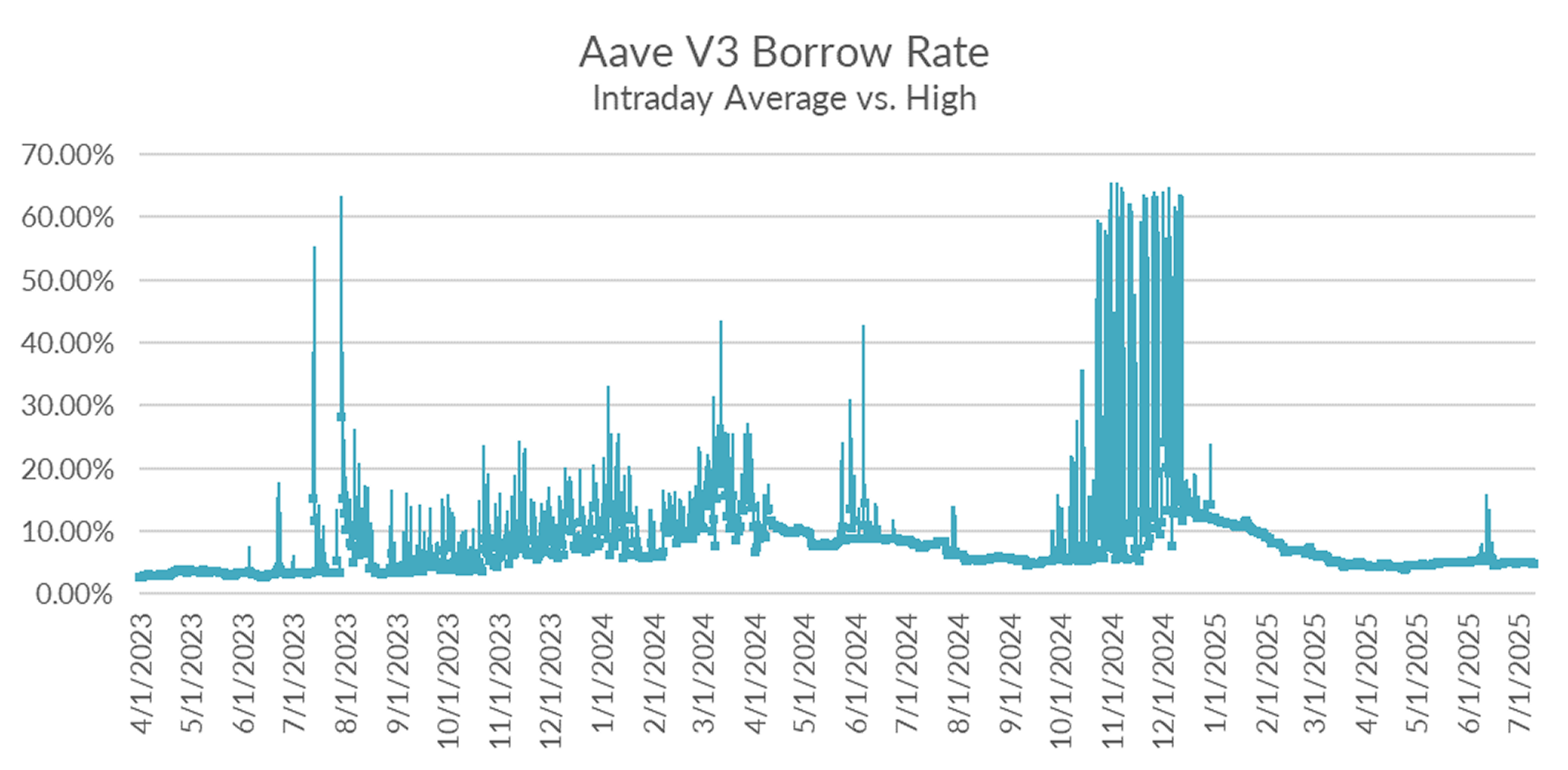

Turning to DeFi variable rate markets, the 30-day trailing average fell -11bps on the week to 5.04%. Over a shorter lookback period (just seven days), Aave borrow rates averaged 5.04% as well, suggesting stable rates in the near term.

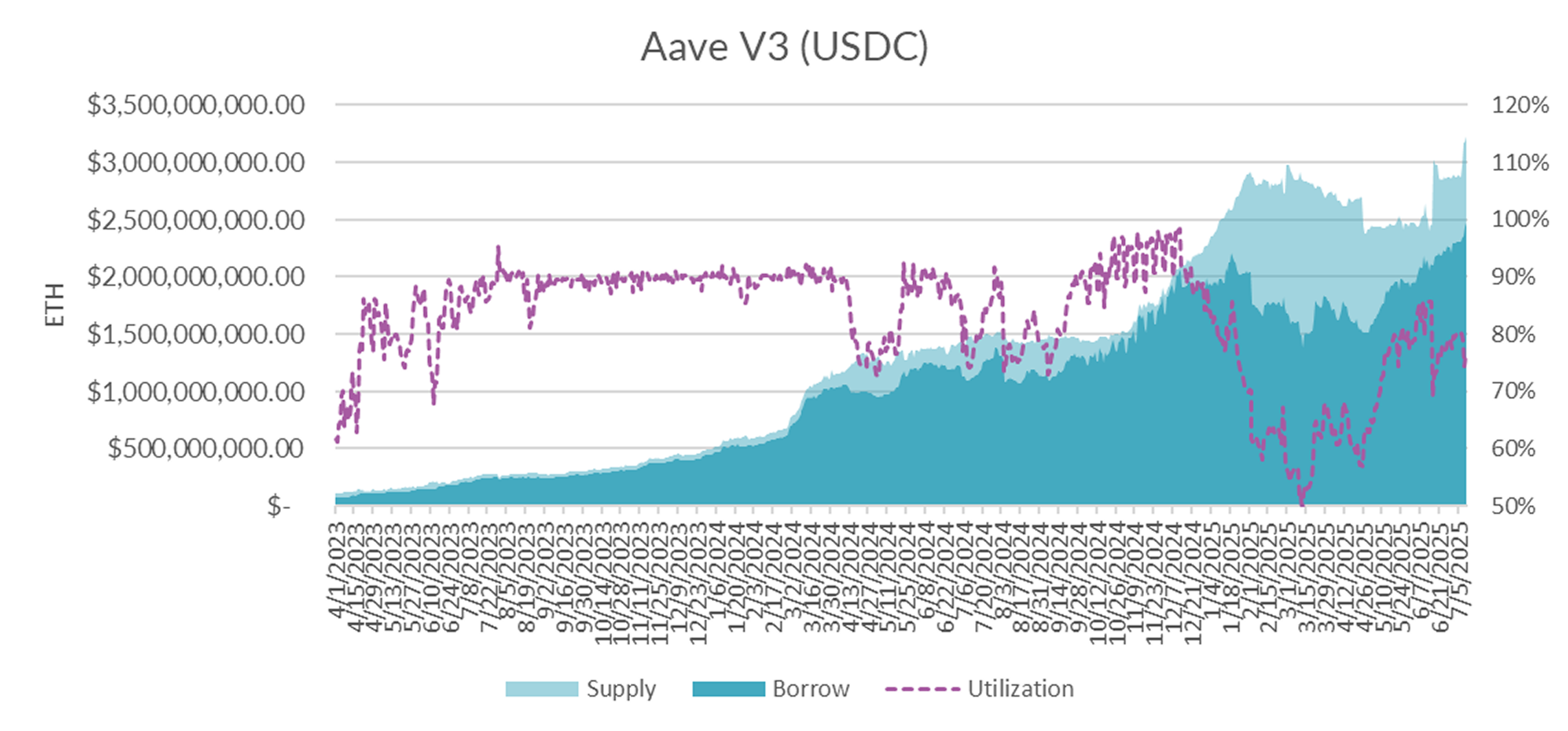

Diving into the microstructure of Aave's USDC markets, utilization fell by a few point to 77%, with lower utilization largely driven by a slight increase of supply.

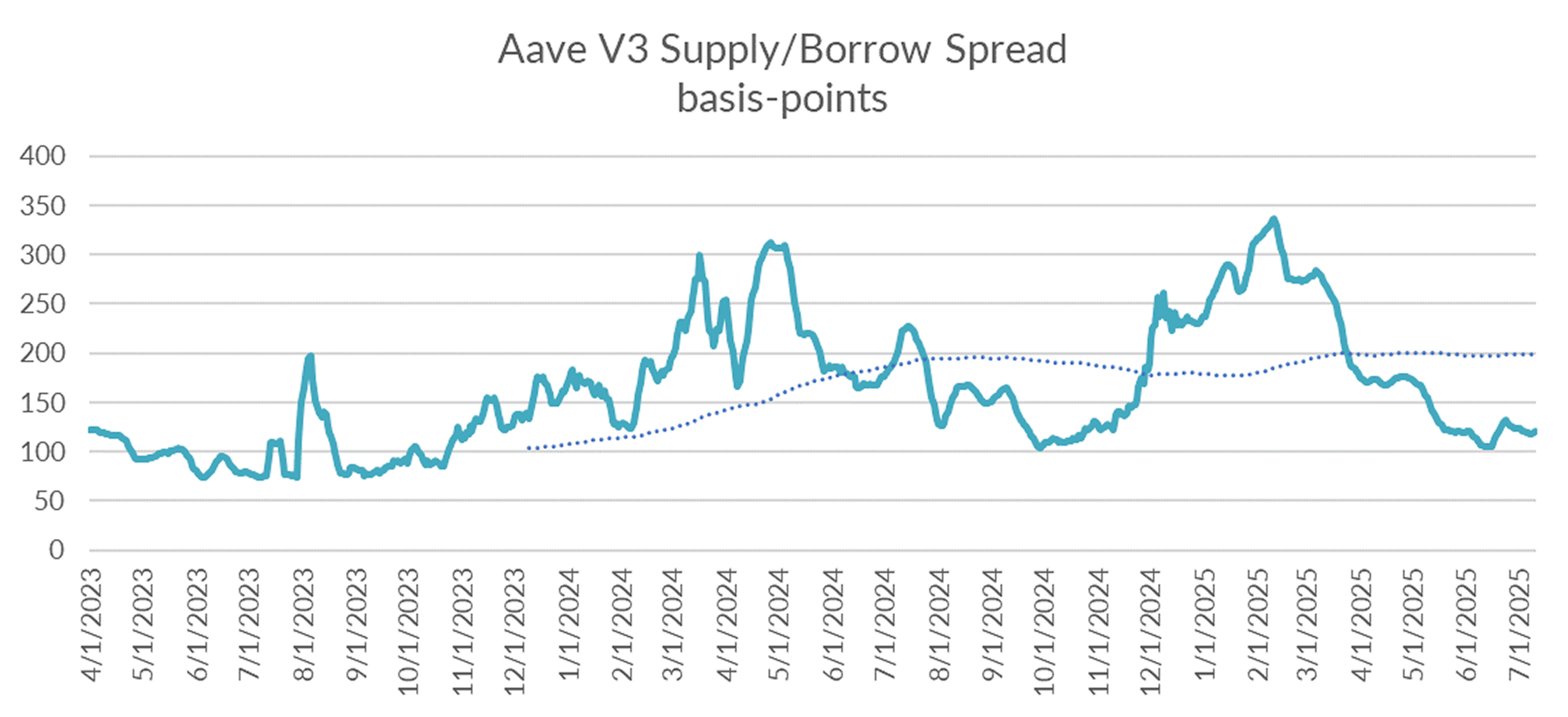

With the overall market relatively balanced, borrow-supply spreads remain near the low end of the range.

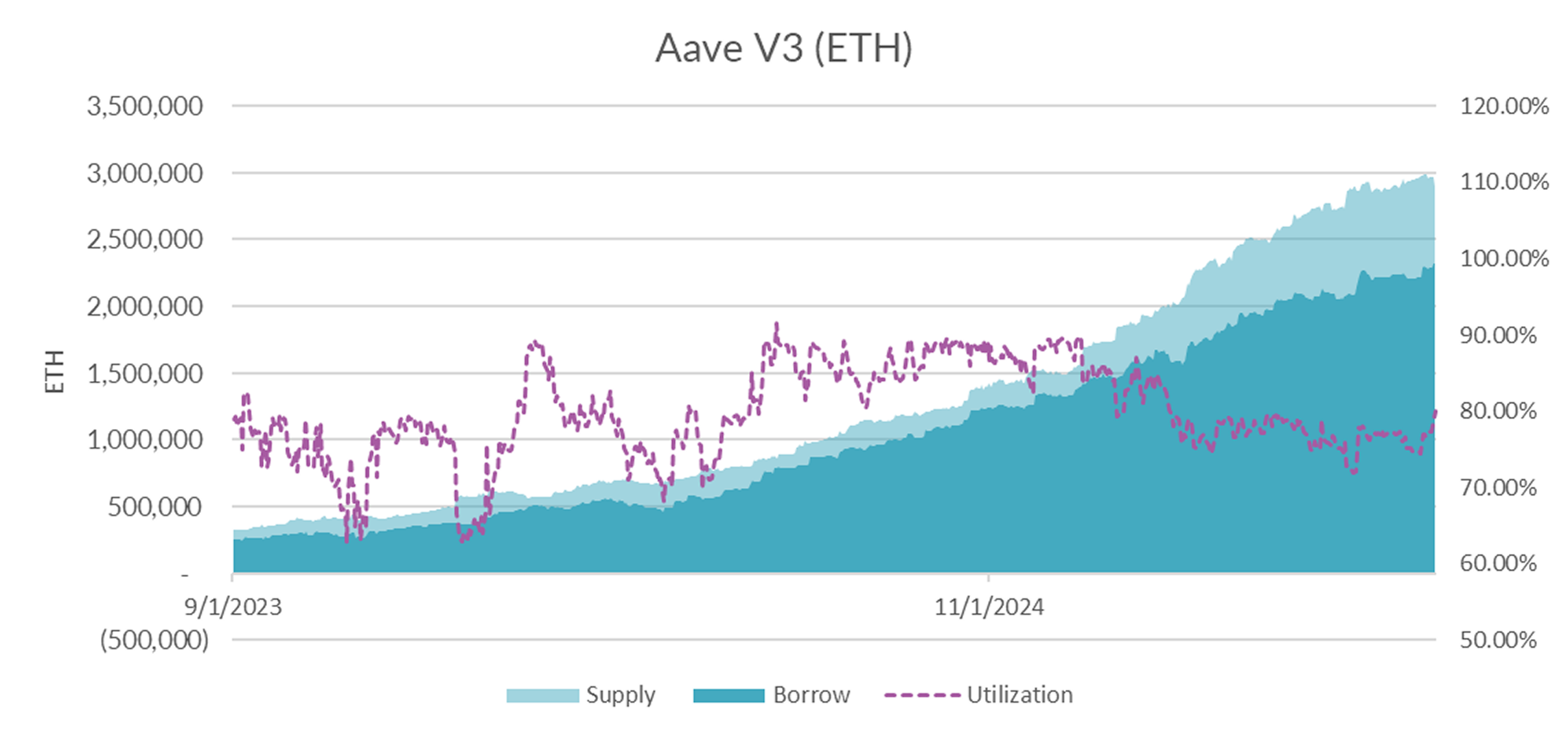

And while demand continues to increase toward new highs, total supply closed the week at a record 3.2M, up 365M from the week prior.

In the near term, markets appear relatively balanced and are expected to remain steady, though as funding rates translate into increased borrow demand (e.g. via the sUSDE channel) expect defi rates to follow.

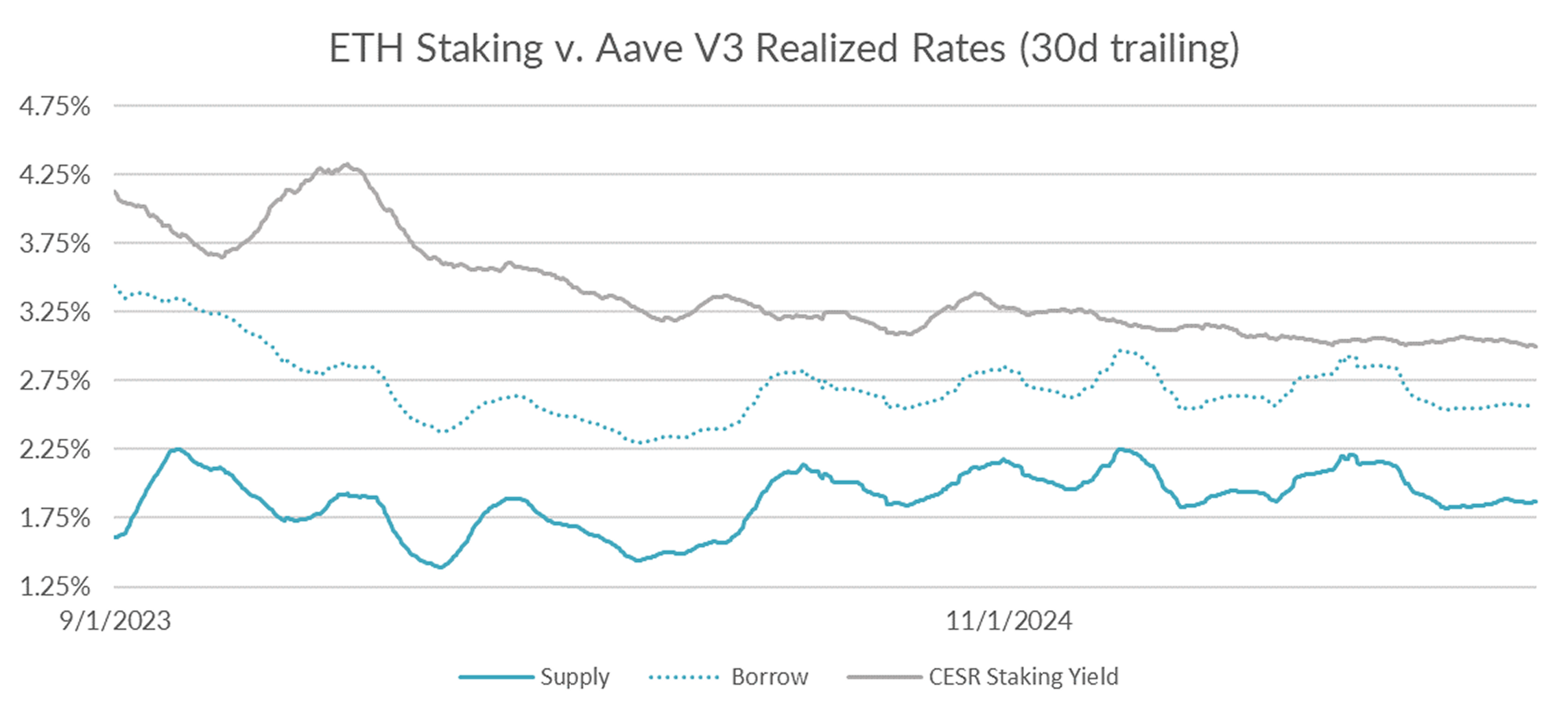

Turning now to ETH markets, ETH rates closed unch’ed on the week at 2.57% on a 30-day trailing basis. The CESR staking index, on the other hand, fell by -2bps to 3.02%, narrowing the spread by -2bp on a 30-day trailing basis.

Market internals show that supply (-86k ETH) fell sharply while demand held steady (+26k ETH) over the past week.

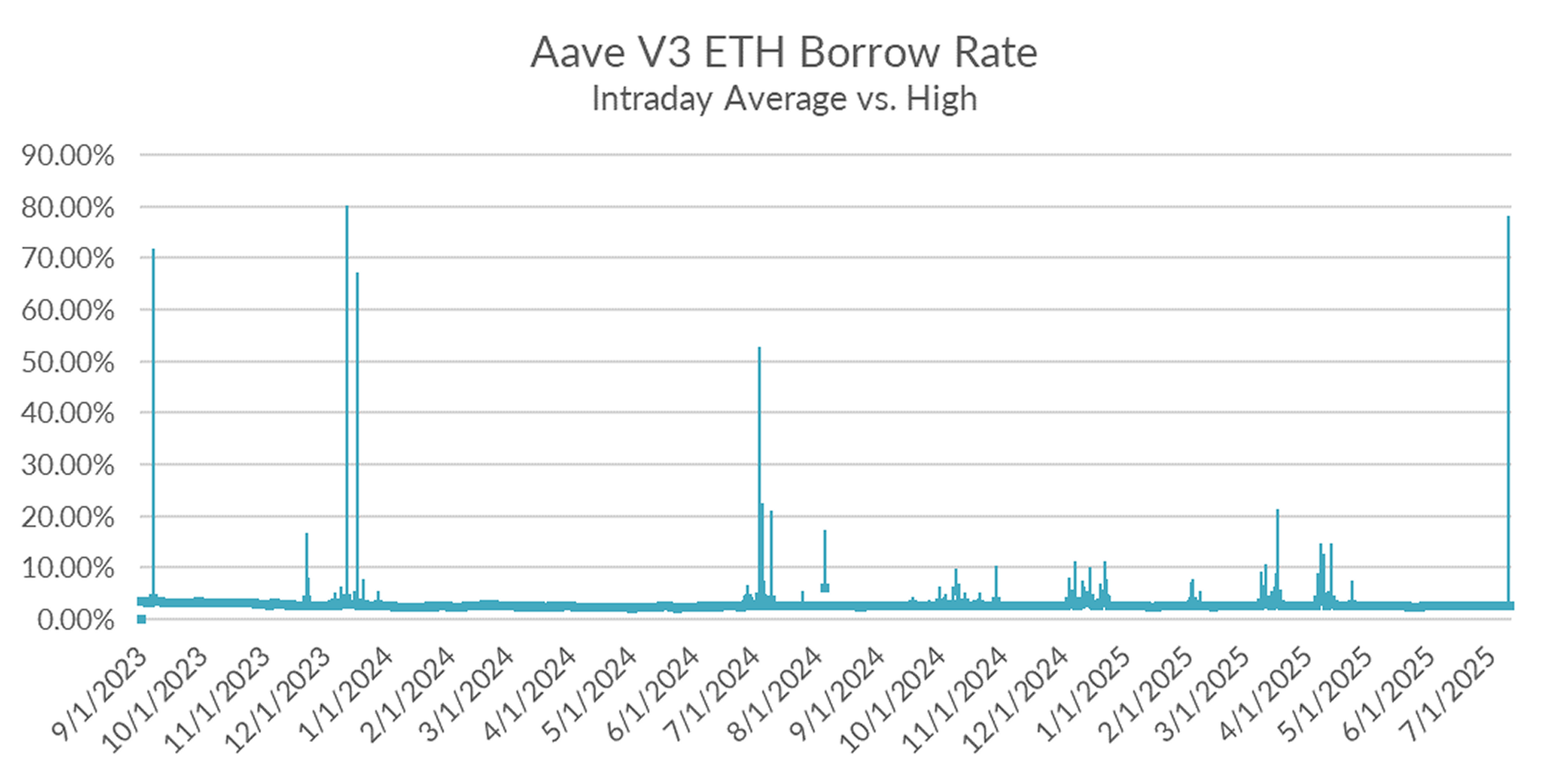

Diving into the intraday charts, we see that ETH borrow rates spiked as high as 66% APY on July 10th, the highest in over a year.

With staking rates compressing, borrow rates have limited room to rise. Expect rates to remain capped in the near term.

After three or four attempts at new all-time-highs over the past few months, BTC finally breaks convincingly to close the week up at 118k. Similarly, after a few false starts at elevated double-digit perpetual funding rates, it seems likely that this time is for real. If perp funding rates can maintain elevated levels over the next week or two, expect DeFi rates to follow suit. In the meantime, lock in fixed-rates on Term!