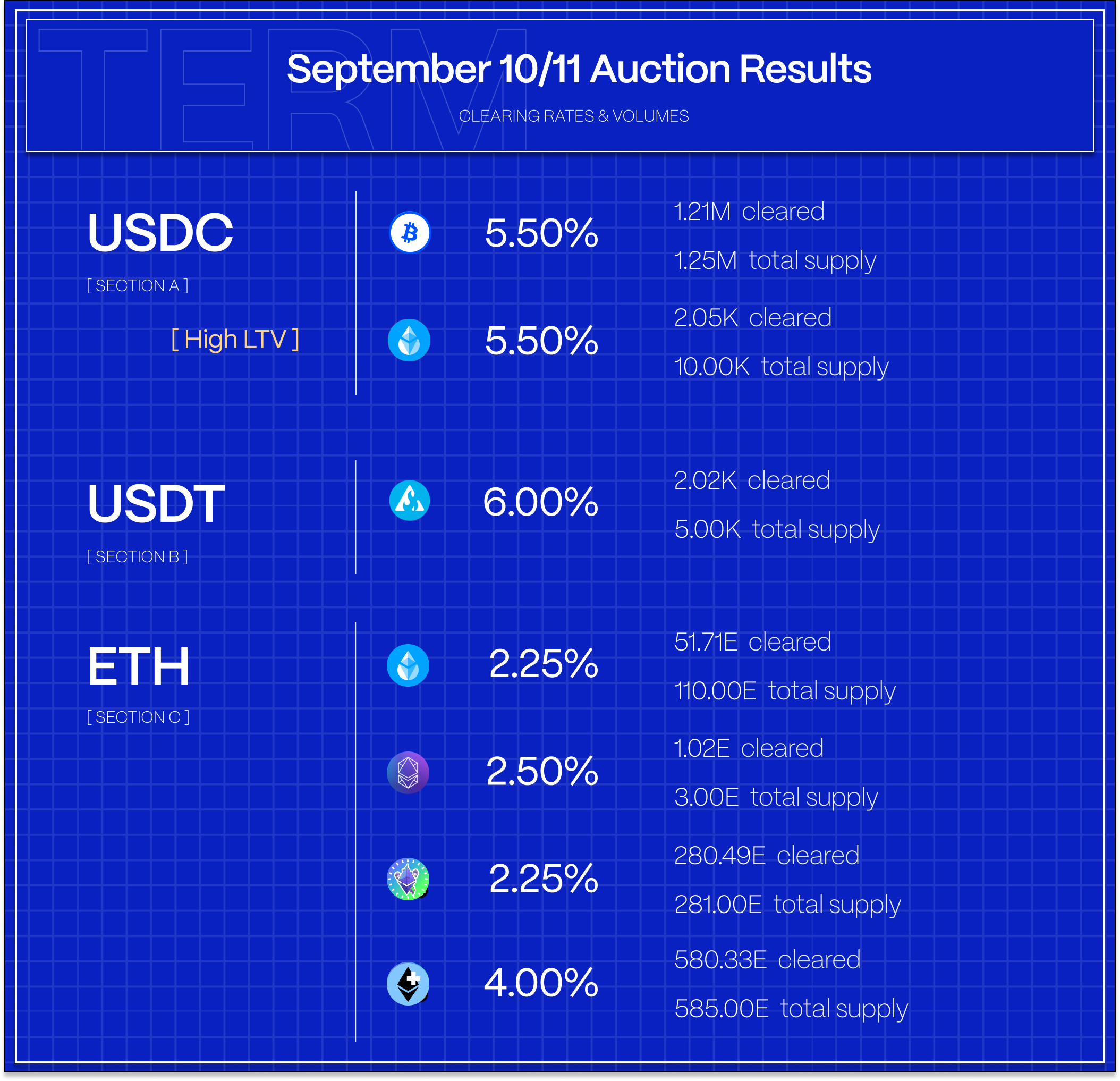

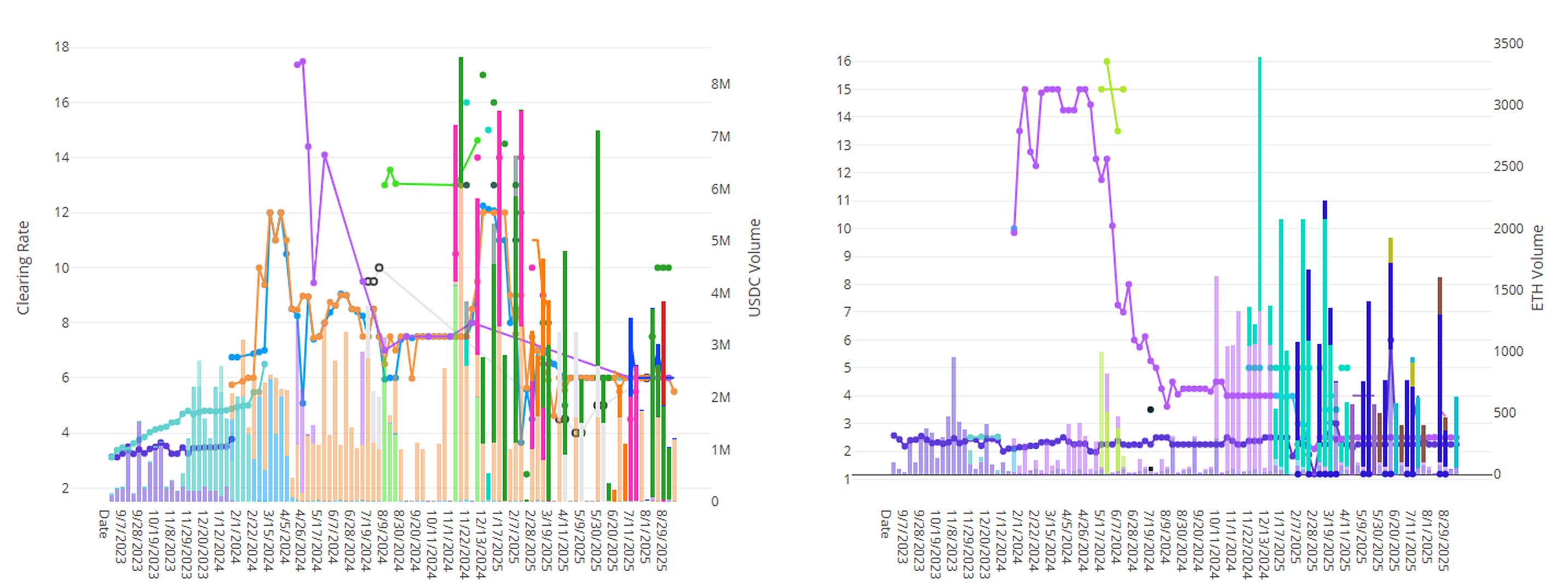

Rates fell slightly on the week against USDC with over 1.25M clearing at 5.5% against cbBTC. ETH markets remain relatively steady at the 2.25-2.50% range for blue-chips and 4.00% for ETH+.

For those eager to lock in fixed rates and hedge against further declines in lending rates, visit our Blue Sheets Simple Earn page to explore current opportunities (Not available to U.S. persons).

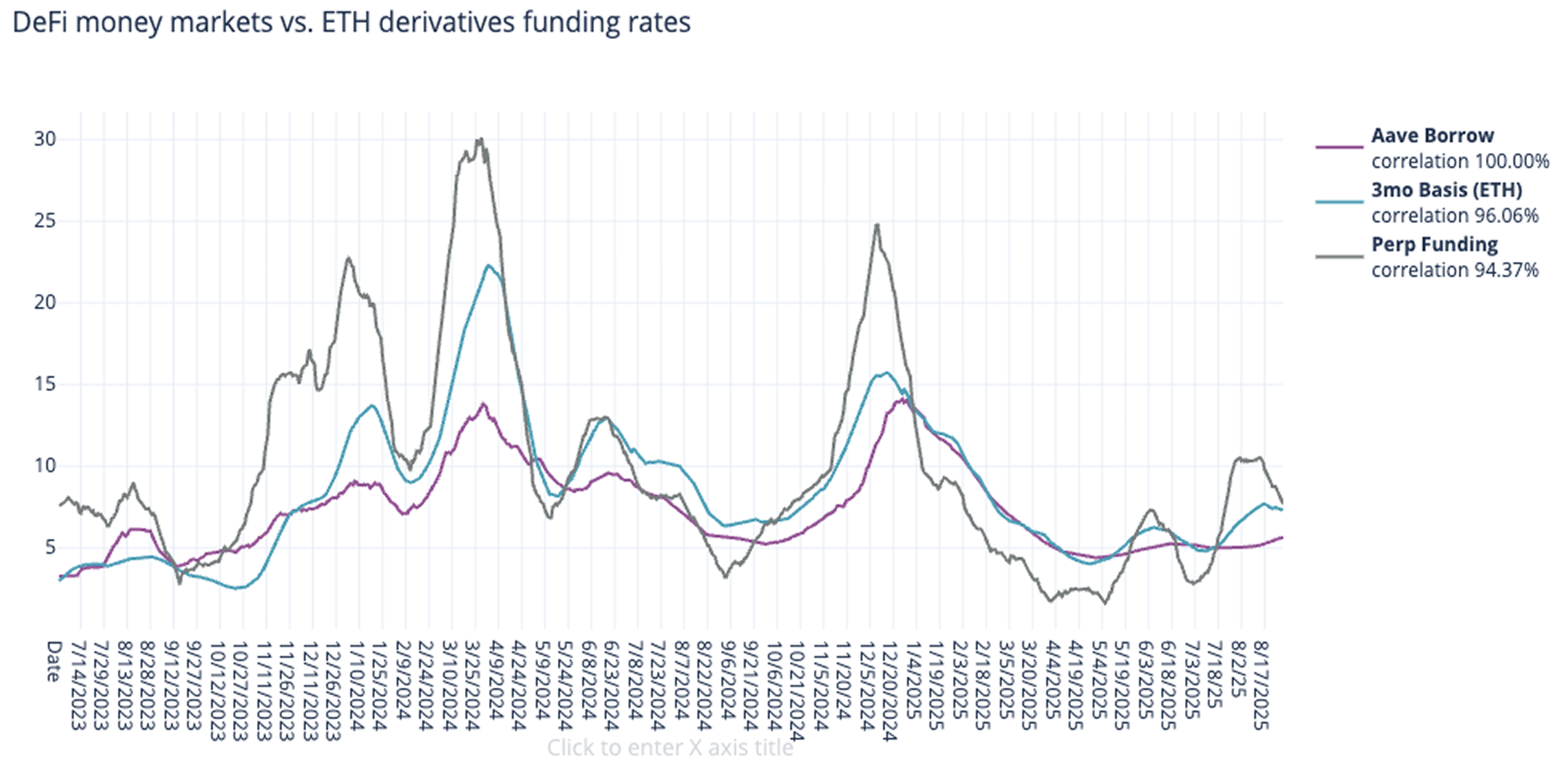

In derivatives markets, funding rates dropped this past week, with 3-month basis falling -43bps to 6.64% and perpetual funding rates down -78bps to 6.87% on a 30-day trailing basis.

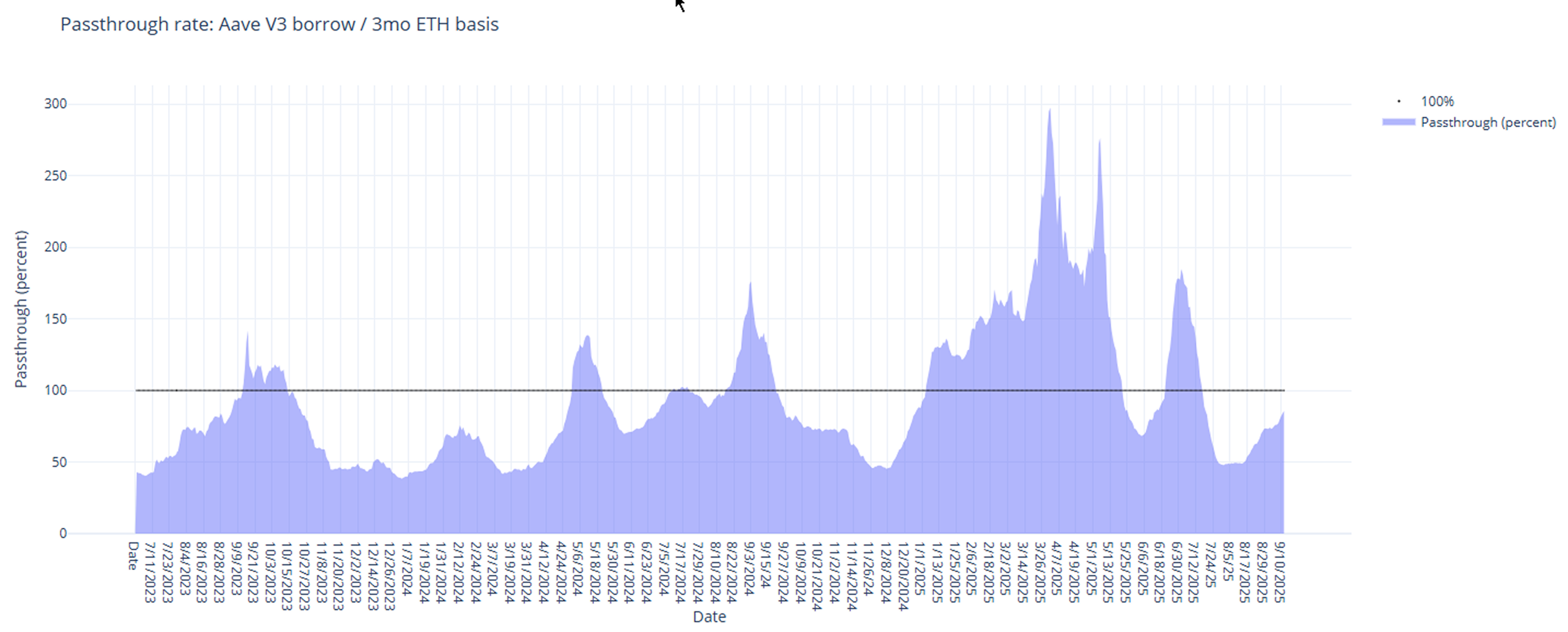

With derivatives funding rates on the decline, the ratio between DeFi and derivatives funding continues to normalize back towards parity.

So long as ETH remains below all-time highs and BTC unable to break resistance around 122k it will be difficult for funding rates to blow out for any material amount of time. Expect rates to stay stay close to current levels absent major surprise next week at the FOMC meeting.

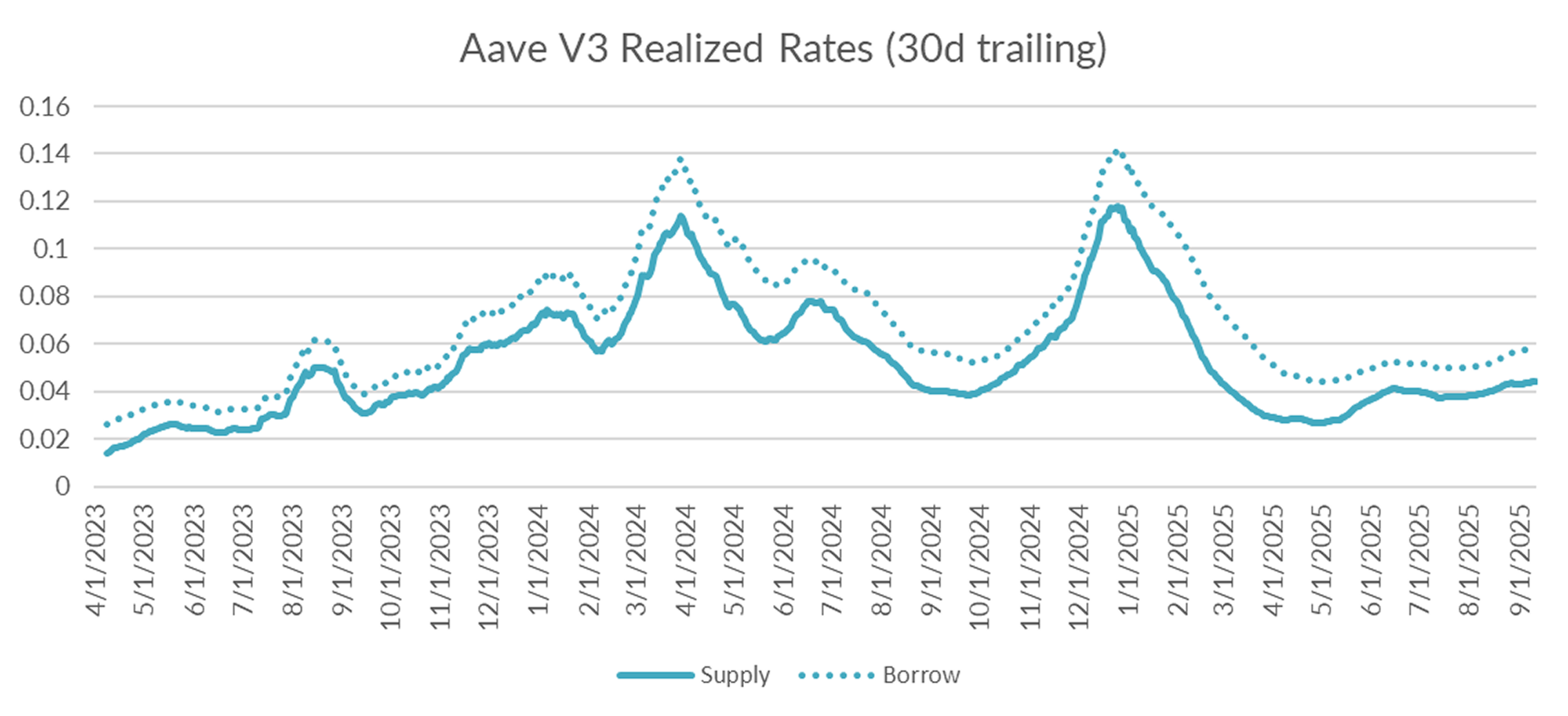

Turning to DeFi variable rate markets, the 30-day trailing average rose +15bps to 5.89% on a 30-day trailing basis. On a shorter lookback period, USDC borrow rates averaged 5.97% suggesting further gains ahead.

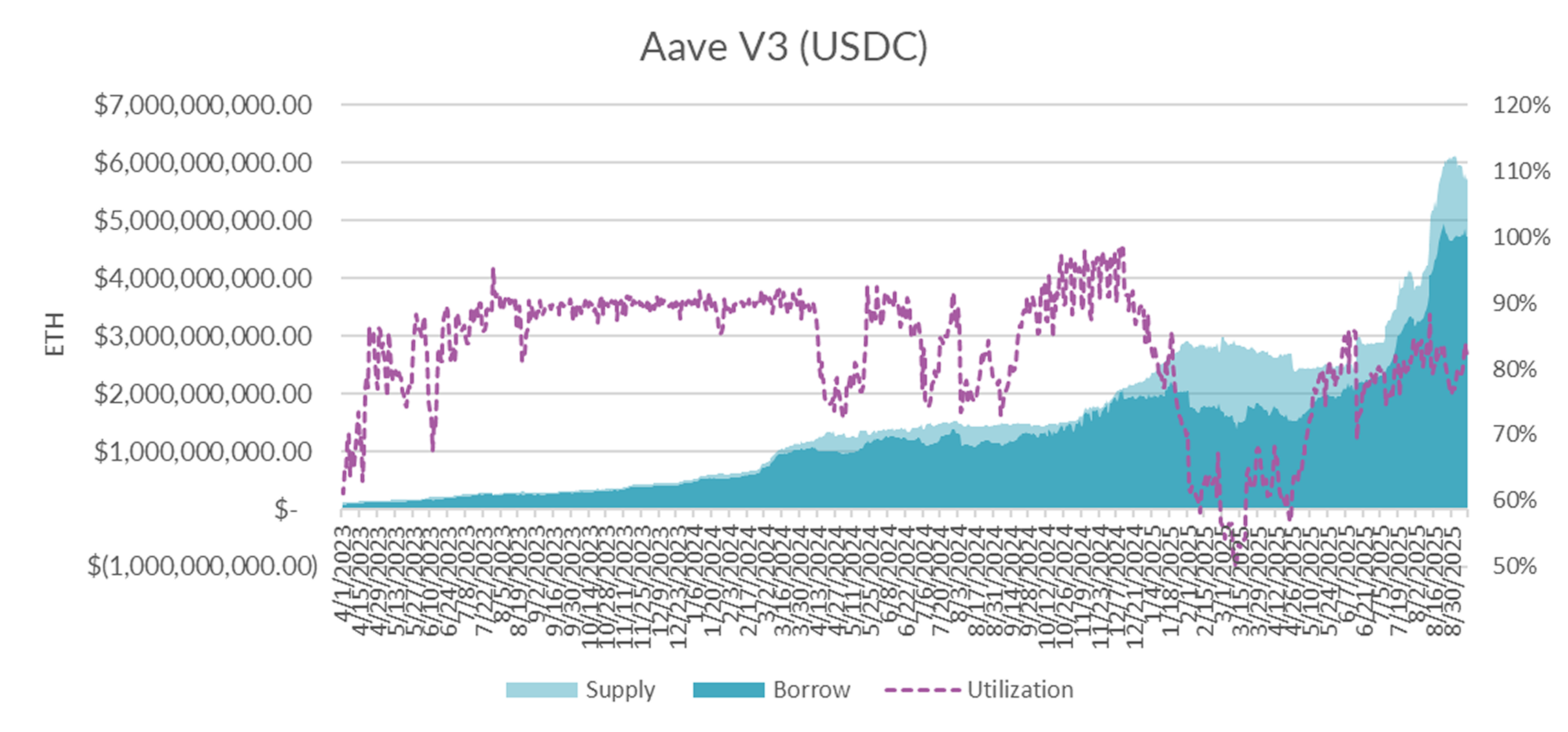

Diving into the microstructure of Aave's USDC markets, USDC supply declined -213M while borrows declined just -650k over the same period, taking utilization back into the mid 80s for the first time since mid-August.

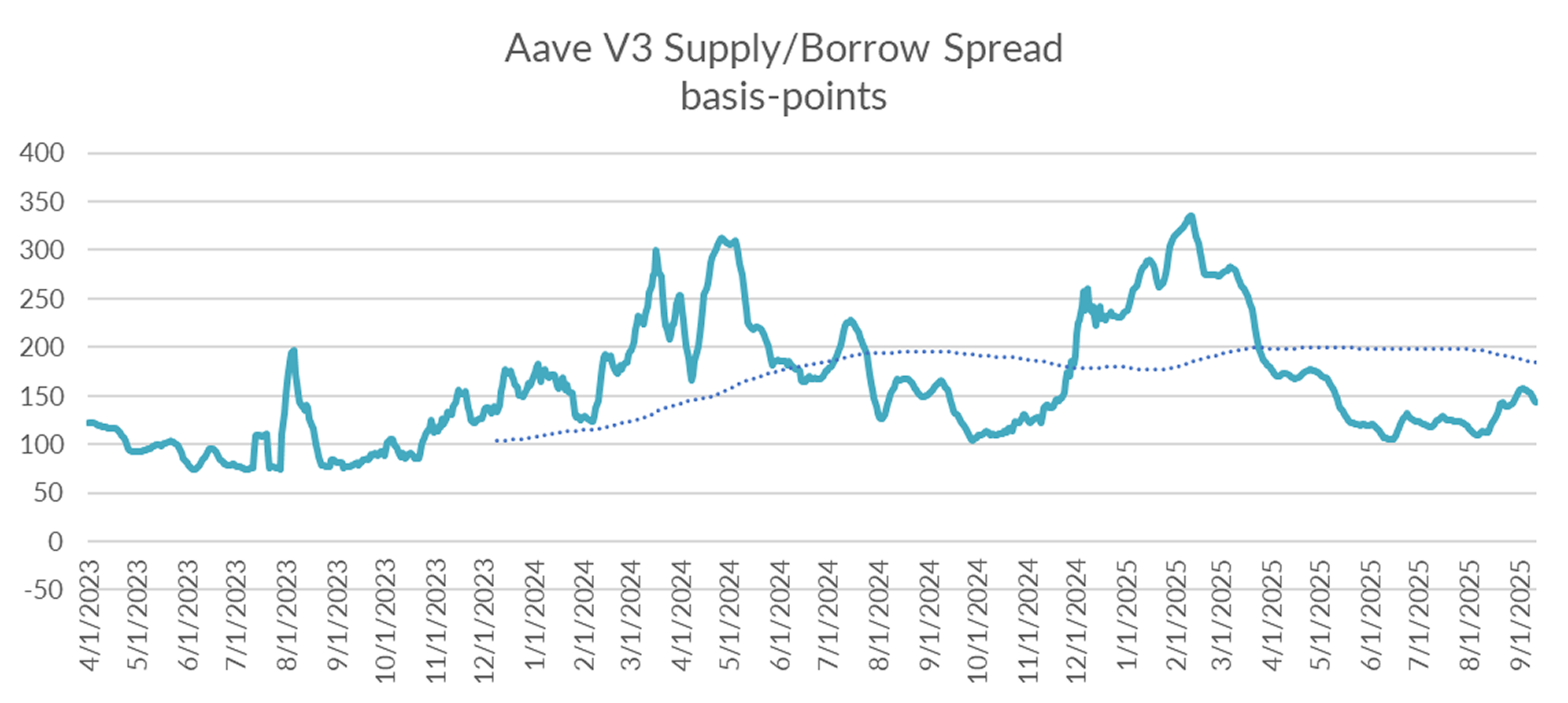

And with rising utilization, supply/borrow spreads on Aave are beginning tighten once more.

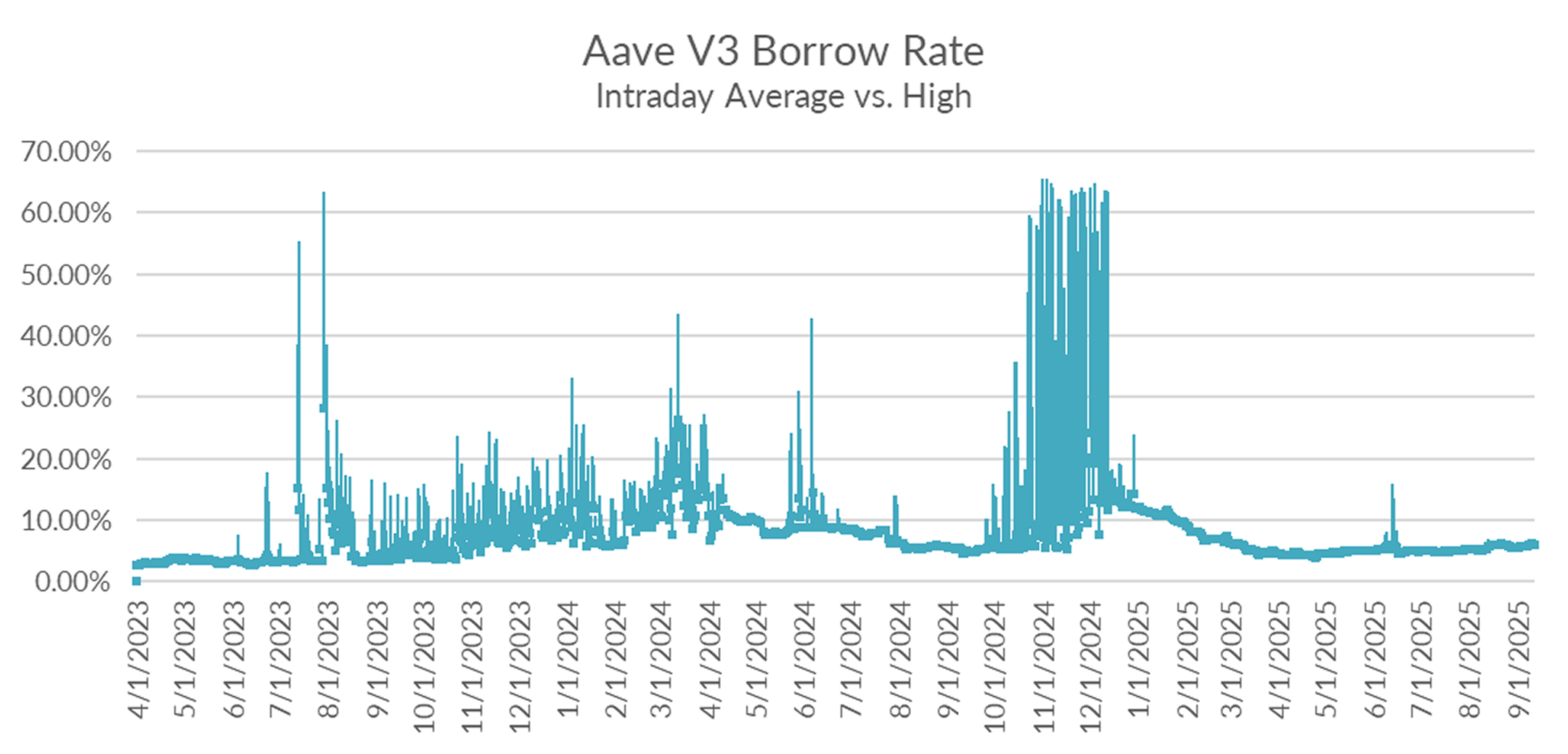

As we’ve seen throughout the year, intraday volatility on Aave has remained subdued. With USDC supply on the platform near all time highs, the market does not appear to be at risk of a sharp squeeze in the near term.

At current levels, USDC on Aave is still 450M short of reaching the kink. Absent a major surprise next week that takes cryptoassets to new highs, expect rates to remain stable in the near term.

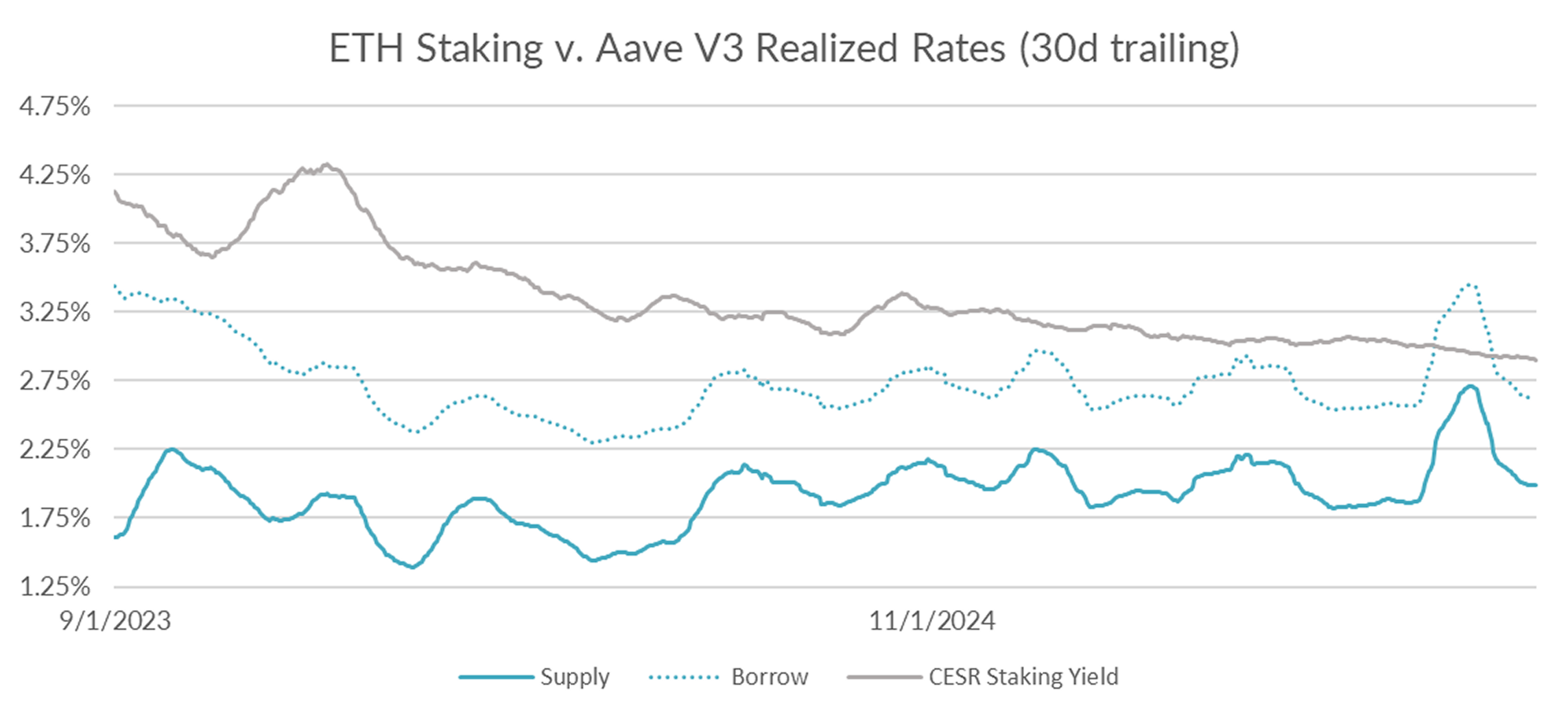

Turning now to ETH markets, ETH rates fell -2bps to 2.62% on a 30-day trailing basis over the past week. The CESR staking index, similarly closed down -2bps on the week at 2.92%, keeping the spread at a historically skinny 30bps.

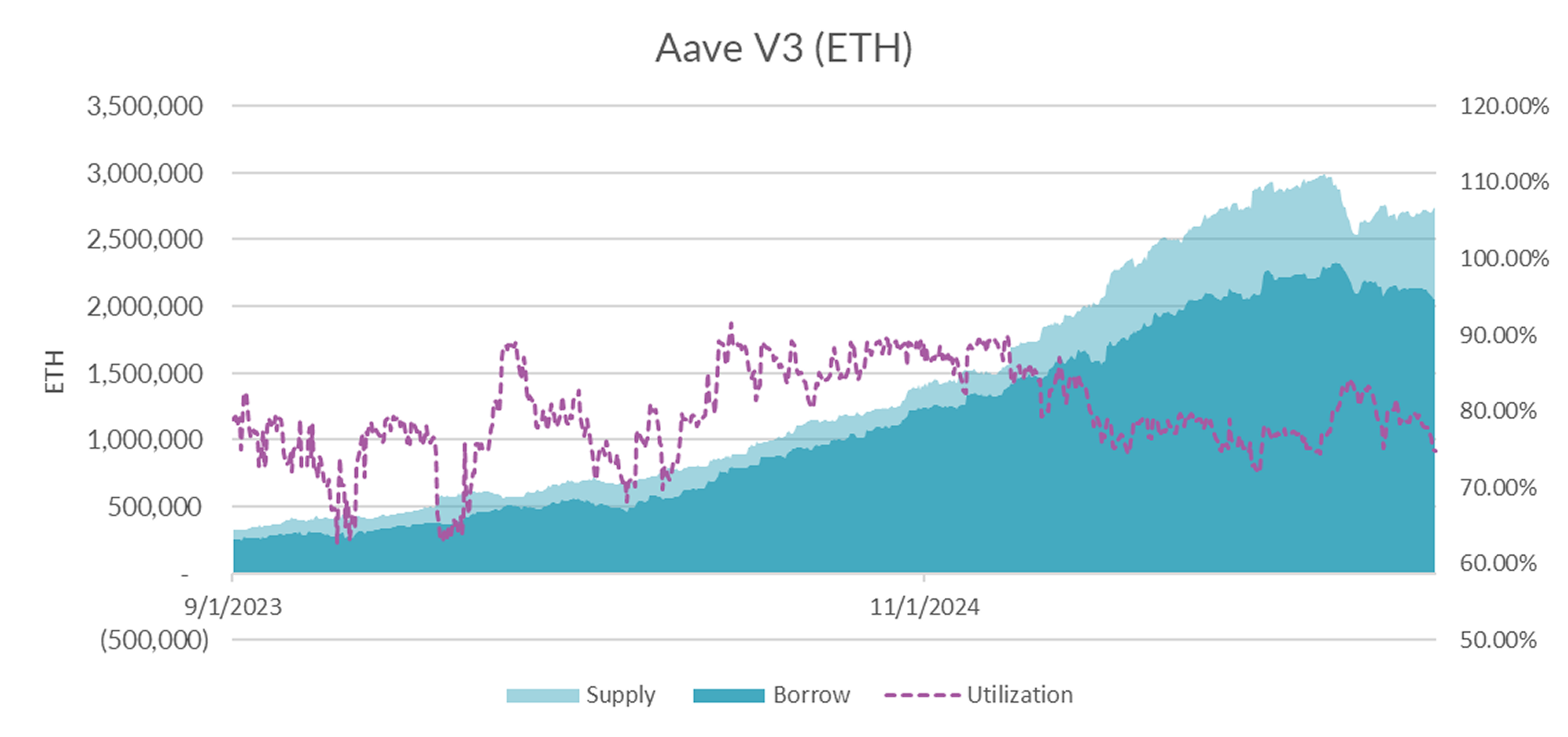

In terms of market microstructure, overall ETH supply appears to be stabilizing around 2.7M ETH with borrows declining at a relatively rapid rate with spot staking yields dropping into the 2.8-2.9% range over the past week.

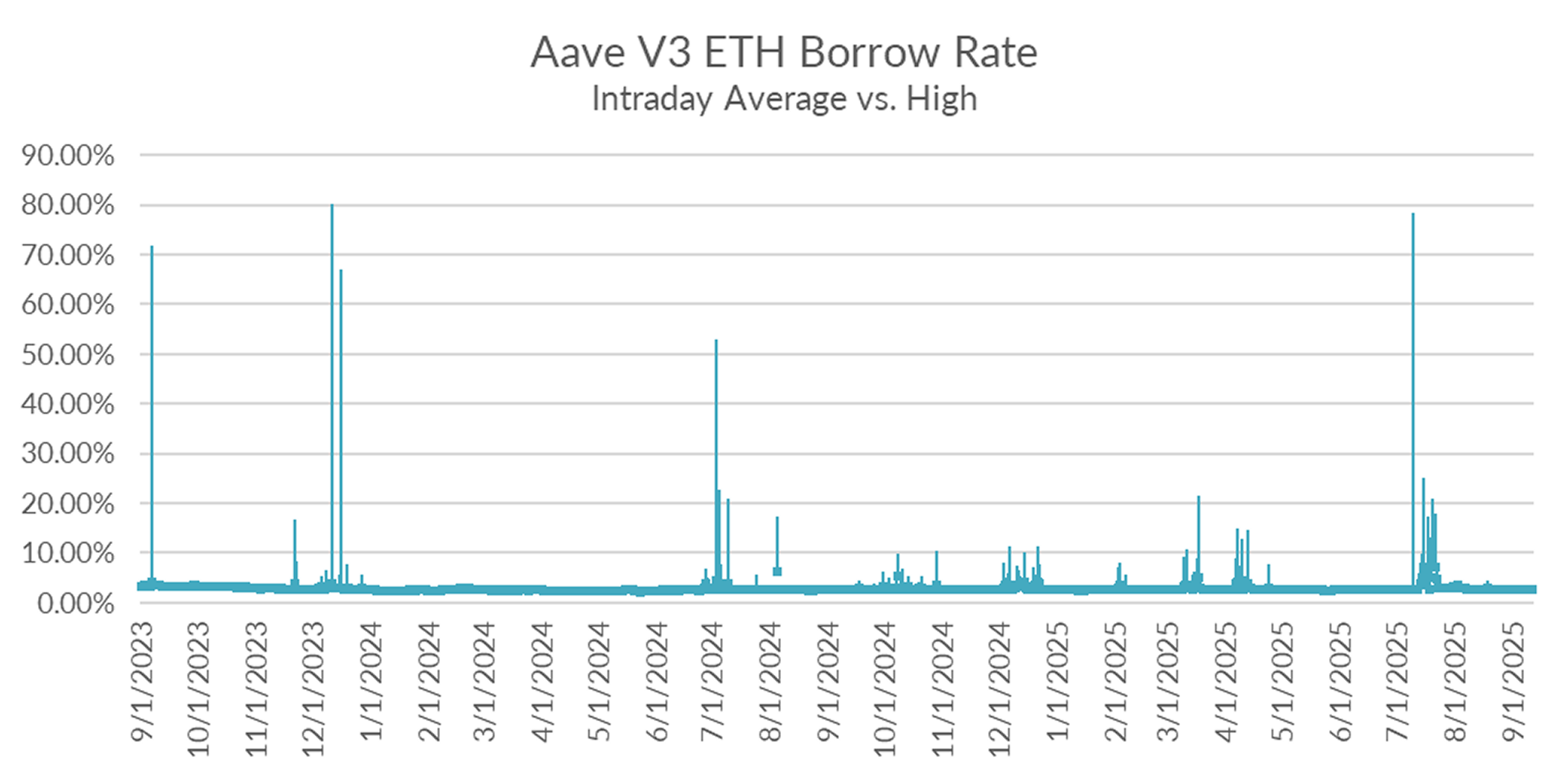

Diving into the intraday charts, we see that ETH borrow rates have been well behaved in recent weeks with no signs of market imbalances.

As long as ETH staking rates continue to decline expect borrow rates to follow. The potential for billions of ETH to be staked in coming weeks as ETH denominated DAT treasuries begin to deploy into LSTs and LRTs will only put further downward pressure on this trend.

All eyes will be on the Fed next week where they are expected to cut by -25bps with a slight tail risk of a -50bp cut. It seems unlikely that markets will react very much if they deliver on market expectations of a 25bp cut. Given this view, expect rates to remain rangebound but keep an eye out for a rally through all-time highs on BTC